E-Invoicing

The E-Invoicing Add-On extends FusionInvoice with the infrastructure required to send electronic invoices through established international networks such as PEPPOL, DBNAlliance, FACeB2B, and Finvoice (where supported). It registers your business with a certified e-invoicing access point, establishes and maintains your network identity, and securely formats and transmits invoices according to applicable standards in supported countries, including:

Europe (Austria, Belgium, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Norway, Poland, Portugal, Romania, Spain, Sweden, Switzerland, UK, Ukraine);

Asia-Pacific (Singapore, Japan, Malaysia, Australia, New Zealand);

North America (Canada, USA, Mexico);

Others (China, India, South Africa, UAE).

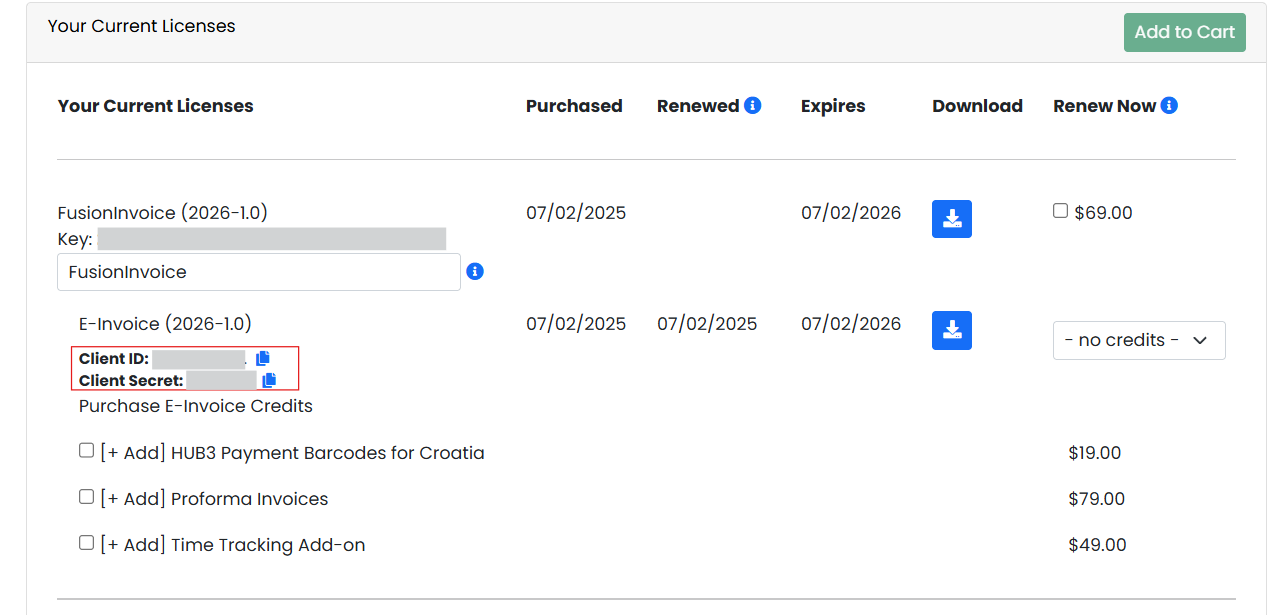

The add-on is enabled through a one time purchase and annual renewal and operates on a credit-based model, with credits consumed as e-invoices are processed and expiring one year after purchase.

Setting Up E-Invoicing in FusionInvoice

Before you can send e-invoices, you must complete several configuration steps inside FusionInvoice and complete your network registration.

Follow the steps below carefully.

Step 1: Install add-on

- Log into your account at FusionInvoice.com and download the add-on package to install. Save it locally to your computer.

- Navigate to the downloaded Add-on package and unzip the contents.

- Upload the unzipped add-on folder from your computer to the custom/addons folder on your server. It is recommended that you use a standard FTP program such as FileZilla to upload the folder to your server.

- Log into your FusionInvoice installation and go to System>Addons>E-Invoicing and click the Install button for the add-on. Once the add-on is installed, the applicable menu items will appear and the add-on will be usable.

Step 2: Configure Add-on and link to E-invoicing provider

- Copy your Client Secret and Client ID from your Fusioninvoice.com account.

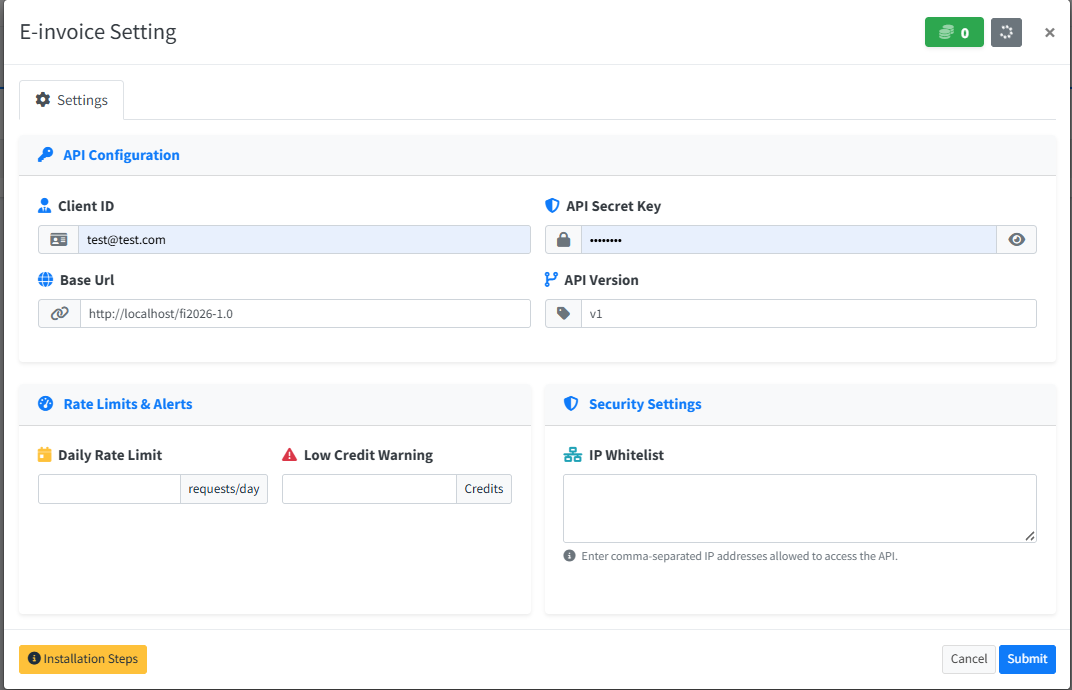

- Navigate to Settings>Addons and find the e-invoicing addon, click the options box to the right and choose "settings".

- Enter your Client ID and Client Secret.

- Set a rate limit (the number of invoice request per day that can be sent) and a low credit warning.

- Click Submit.

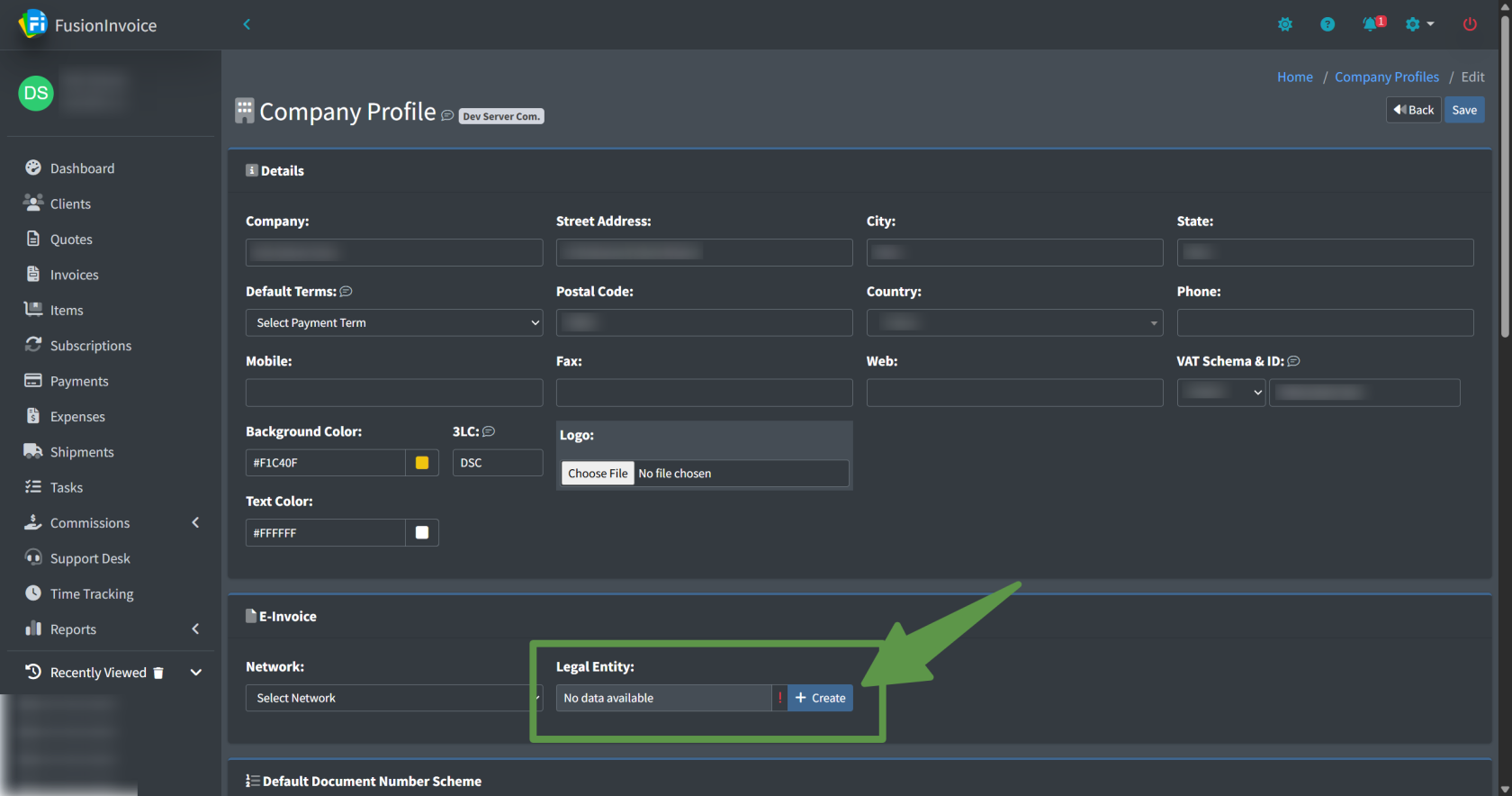

Step 3: Configure Company VAT Information

*Your VAT Schema and VAT ID must be correctly configured before your business can be registered on the e-invoicing network.*

Step 4: Complete PEPPOL Network Registration

To send e-invoices via PEPPOL (where applicable), your business must be registered on the network.

⚠️ You cannot send e-invoices until you receive approval confirmation of your PEPPOL registration.

Step 5: Configure Client VAT Information

For each client you intend to send e-invoices to:

-

Open the client record.

-

Enter the client’s:

-

VAT Schema

-

VAT ID

-

Both fields must be properly completed for e-invoice routing to succeed.

Step 5: Configure VATZERO Tax

All invoice line items must have a VAT tax applied before an invoice can be submitted as an e-invoice.

This includes invoices with zero tax. If there is no tax:

-

Create a tax named VATZERO (if it does not already exist).

-

Set the tax rate to 0%.

-

Apply this VATZERO tax to any untaxed invoice line items.

📌 Important:

Even untaxed line items must have a VAT tax applied. If no VAT tax is applied, the invoice cannot be submitted as an e-invoice.

Sending an E-Invoice

Once:

-

Company VAT information is configured

-

Client VAT information is entered

-

VATZERO tax is created

-

PEPPOL registration has been approved

You are ready to send e-invoices.

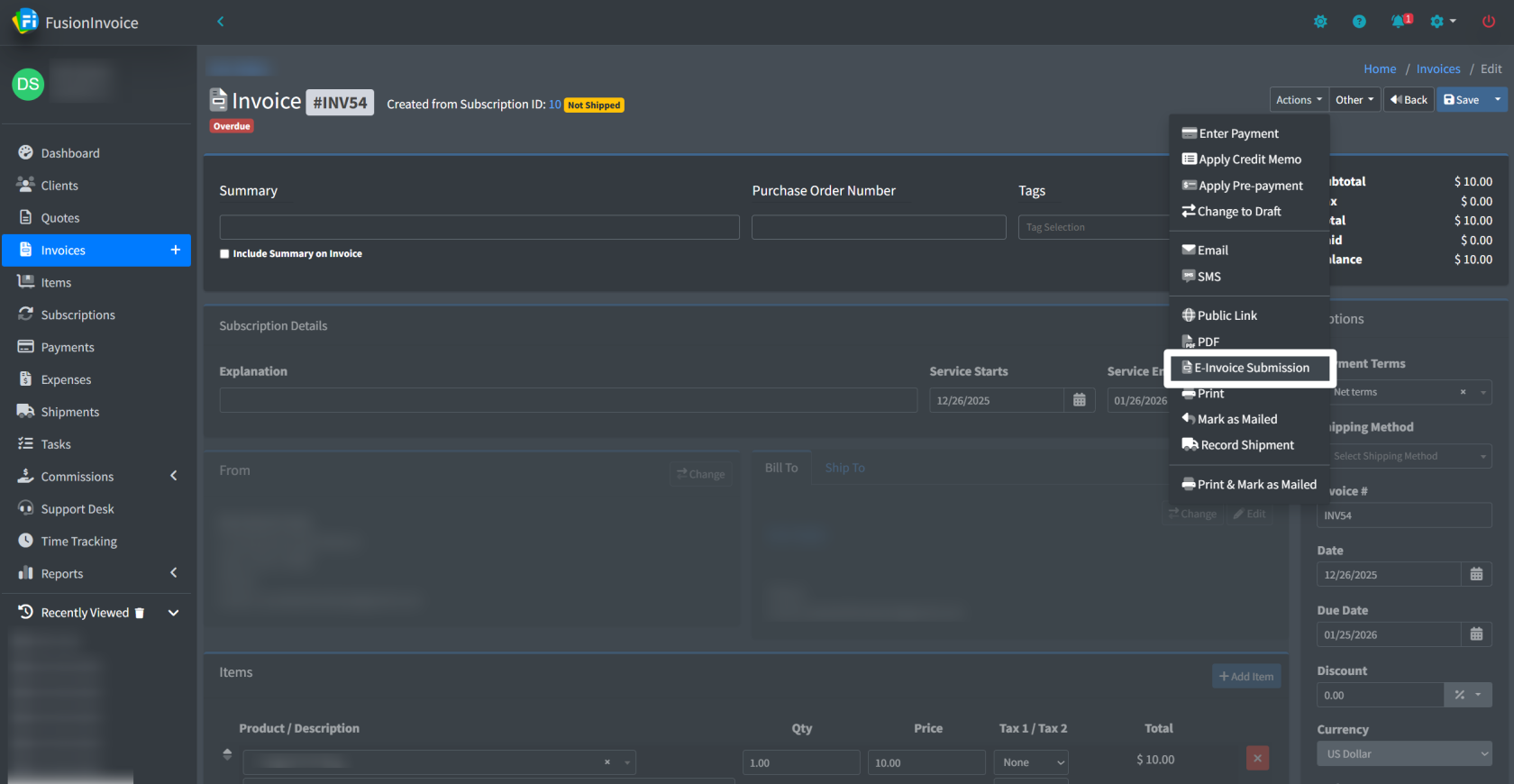

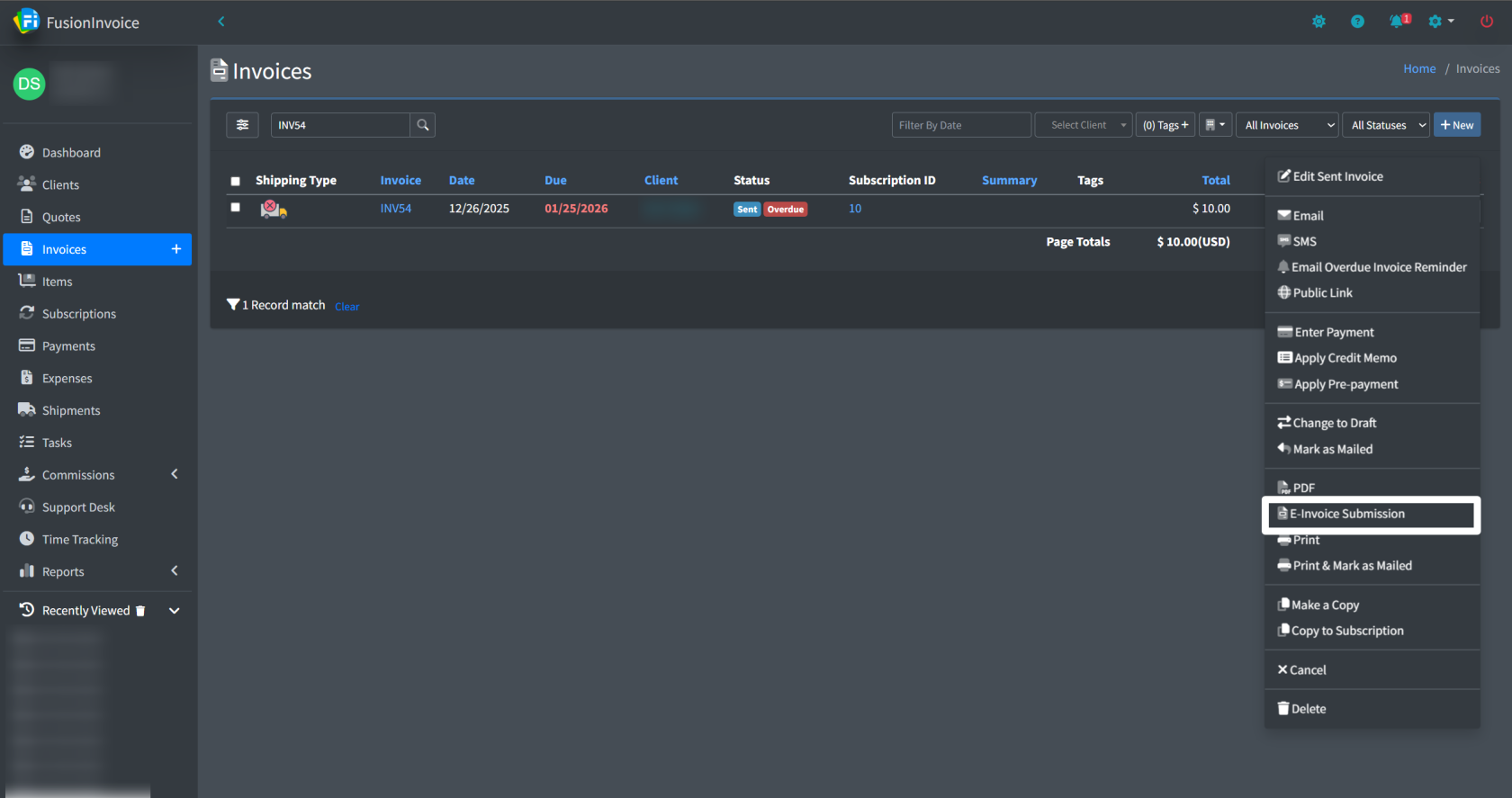

Submit an E-Invoice

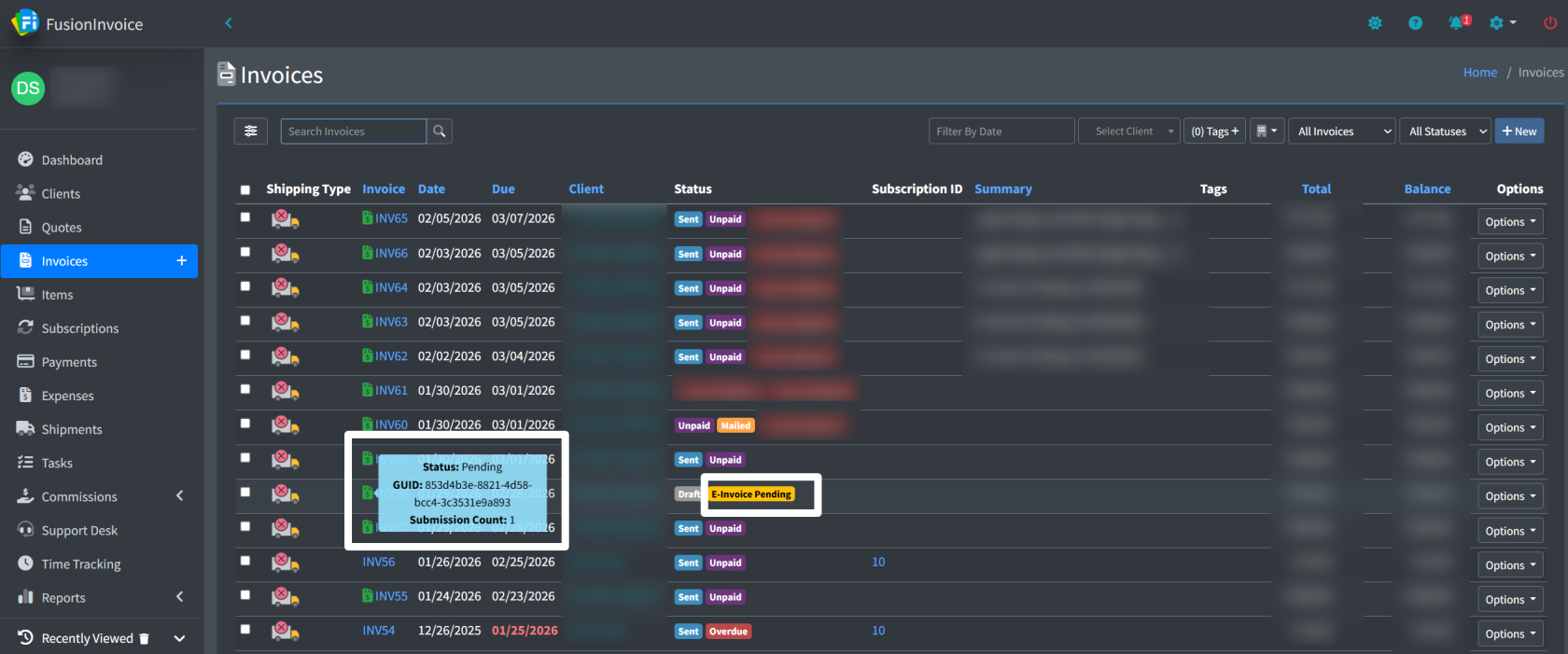

The invoice will then be processed and transmitted via the configured e-invoicing network.

Re-Submitting an Invoice

If you need to make changes to an invoice after submission:

-

Edit the invoice as needed.

-

Return to the Options or Actions menu.

-

Select Re-Submit.

The system will transmit the updated version through the network.

Important Reminders

-

All invoice line items must have a VAT tax applied (including 0% VATZERO).

-

Your business must be approved on the PEPPOL network before sending.

-

Client VAT Schema and VAT ID are required for routing.

-

Credits are consumed when an e-invoice is processed.

-

Credits expire one year after purchase.