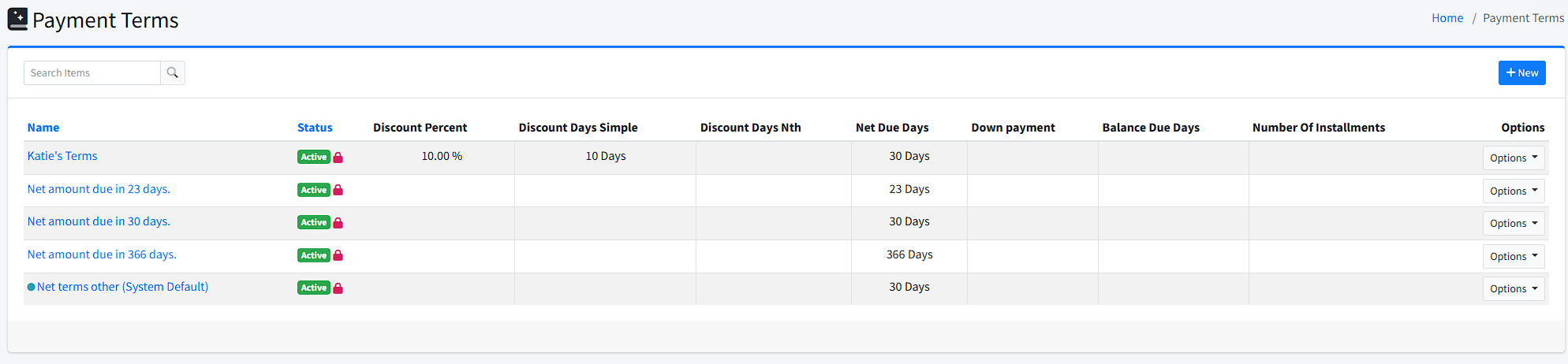

Payment Terms

Payment Terms define the conditions under which your customers must settle their invoices or quotes. By configuring these terms, you can specify when payments are due, offer early payment incentives, require down payments, or establish installment plans. Once created, payment terms can be applied at various levels: individual invoices, quotes, as a default setting for a specific client, or as a system-wide default.

Accessing the Payment Terms Screen

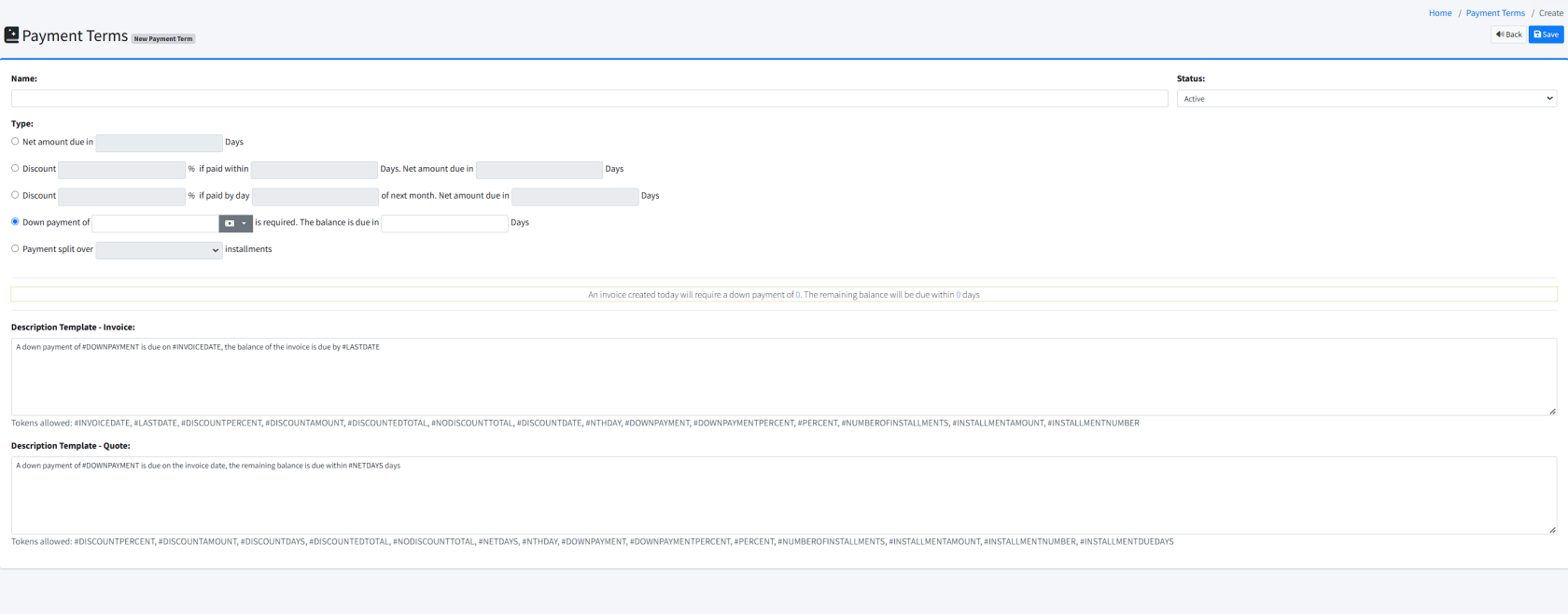

Configuring Payment Terms

When creating or editing a payment term, you will see fields and options that allow you to define how and when payment is expected:

Name

A descriptive text title, set by you, for the payment term, such as "Net 30," "50% Down, Net 15," or "2% Early Payment Discount."

Status

Indicates whether the payment term is currently Active (available for use) or Inactive (not selectable for future invoices or quotes).

Types of Payment Terms

You can create various types of payment terms depending on your business requirements:

-

Net Amount Due

- Specify the number of days from the invoice or quote date by which the full amount must be paid (e.g., "Net amount due in 30 days").

-

Discount for Early Payment

- Offer a discount if the customer pays within a certain timeframe. For example:

- "2% if paid within 10 days, net amount due in 30 days"

- "1% if paid by the end of the next month, net amount due in 60 days"

- These options encourage prompt payments and provide clarity on when the remaining balance is due if the discount period is not met.

- Offer a discount if the customer pays within a certain timeframe. For example:

-

Down Payment Required

- Require an upfront payment (a fixed amount or percentage) before the start of work or the release of goods.

- Specify the number of days in which the remaining balance is due after the initial down payment.

- Example: "A down payment of 20% is required on the invoice date, with the remaining 80% due within 30 days."

-

Payment Split Over Multiple Installments

- Set up a series of evenly spaced installments for the total amount due.

- Define the number of installments and the interval (in days) between payments.

- Example: "Payment split over 3 installments, each due 30 days apart."

Description Templates

Each payment term can include a description template that automatically populates the terms section of relevant invoice or quote documents with standardized text. This helps communicate payment conditions clearly to your clients.

- Invoice Description Template: A default message that appears on invoices.

- Quote Description Template: A default message that appears on quotes.

Tokens are placeholders that dynamically insert values based on the current invoice or quote. Common tokens include:

#INVOICEDATE: The invoice’s creation date.#LASTDATE: The calculated date by which the full payment is due.#DISCOUNTPERCENT,#DISCOUNTAMOUNT, and#DISCOUNTDAYS: Information about applicable early payment discounts.#DOWNPAYMENTor#DOWNPAYMENTPERCENT: The initial amount or percentage due upfront.#NTHDAYor#NETDAYS: The number of days after which the payment is due.#NUMBEROFINSTALLMENTS,#INSTALLMENTAMOUNT,#INSTALLMENTNUMBER,#INSTALLMENTDUEDAYS: Details for installment-based payment structures.

For example, a description template might read:

"A down payment of #DOWNPAYMENT is due on #INVOICEDATE, and the remaining balance is due by #LASTDATE."

When the invoice is generated, FusionInvoice replaces the tokens with actual values, ensuring that clients receive clear, accurate payment instructions.

Applying Payment Terms

After creating payment terms, you can apply them in several ways:

- System Default: Set a particular payment term as the default for all newly created invoices and quotes system-wide.

- Client-Level Default: Assign a payment term as the default for a specific client so that any invoice or quote generated for that client automatically uses those terms.

- Invoice or Quote Level: Override the default payment term when creating or editing an individual invoice or quote. This allows you to tailor payment conditions for particular transactions without affecting your global or client-level settings.

Examples

-

Early Payment Discount:

- Name: "2%/10 Net 30"

- Description (Invoice): "A 2% discount applies if paid within 10 days. The full amount is due in 30 days."

- When an invoice is generated, the due date and discount details will appear accordingly.

-

Down Payment Requirement:

- Name: "50% Down, Net 15"

- Description (Invoice): "A down payment of #DOWNPAYMENT (50% of the invoice total) is due on #INVOICEDATE, with the remaining balance due by #LASTDATE."

- This ensures the client is aware of the required initial payment and the final due date for the remainder.

-

Installment Payments:

- Name: "3 Equal Installments"

- Description (Invoice): "#NUMBEROFINSTALLMENTS installments of #INSTALLMENTAMOUNT each are due every #INSTALLMENTDUEDAYS days."

- Ideal for larger projects where spreading out payments reduces client burden and improves cash flow forecasting.

By leveraging the Payment Terms feature, you can standardize how and when you expect payment, improve cash flow, and simplify communication with clients—ultimately making your billing process more transparent and efficient.