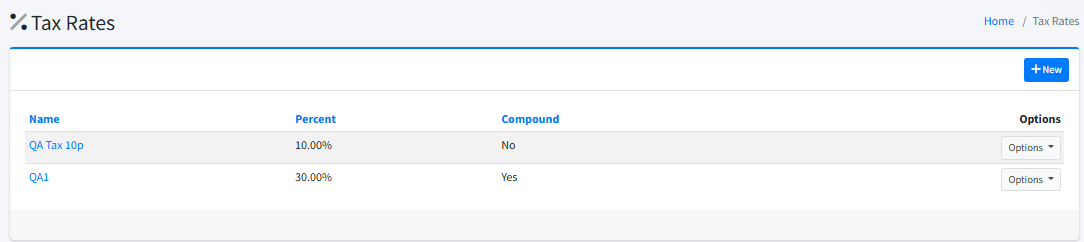

Tax Rates

Tax Rates allow you to define and manage the percentage values used to calculate taxes on invoices and quotes. These tax rates are applied at the line item level, offering flexibility and precision in how you charge taxes to your clients.

Location:

System > Configuration > Tax Rates

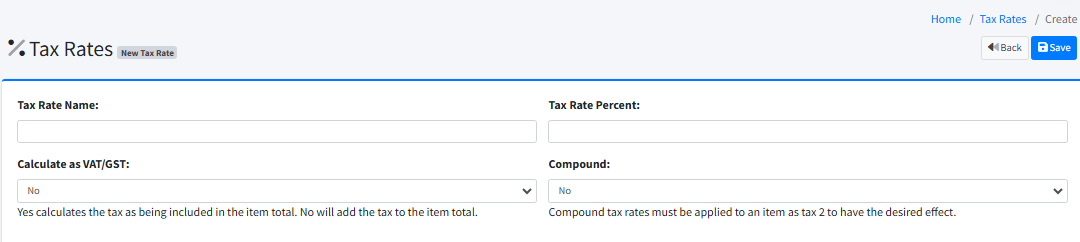

Creating and Managing Tax Rates

Applying Tax Rates to Items

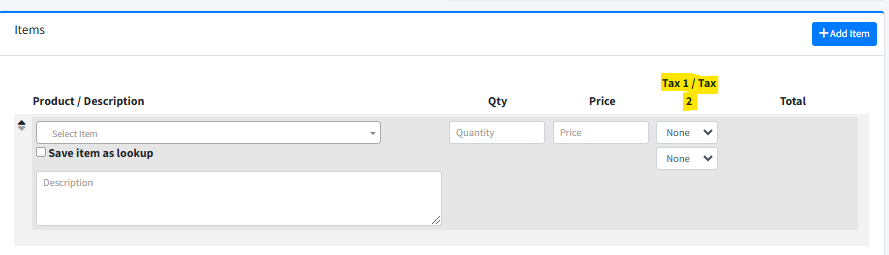

FusionInvoice supports up to two tax fields per line item. Once tax rates are configured:

-

On Invoices and Quotes:

When adding or editing a line item on an invoice or quote, you can select from the defined tax rates. If two tax fields are enabled in your System Settings, you can apply one tax as “Tax 1” and another as “Tax 2” (if needed, such as for compound taxes). -

Calculations and Totals:

When you select a tax rate for an item, the tax amount is automatically calculated and included in the line item’s total. If a compound tax rate is used as Tax 2, it will be calculated based on the subtotal plus the amount of Tax 1.

Best Practices

-

Consistent Naming:

Use clear, descriptive names for your tax rates so it’s obvious which region or purpose they serve. -

Test Your Calculations:

Before sending invoices or quotes, review calculations to ensure the tax amounts are correct, especially when using compound or VAT/GST-inclusive taxes. -

Stay Compliant:

Keep tax rates up to date with current laws and regulations in your area. Update or create new tax rates as necessary.